Flipping properties in Scotland can be a great way to make money, but it’s not as simple as just buying and selling houses. For beginners, it can be tricky to know where to start. You need to find the right property, plan your renovations, and understand the legal rules.

This article will walk you through the basics of property flipping in Scotland, so you know what steps to take to be successful. Whether you’re looking to flip properties in Glasgow, Edinburgh, or anywhere else, this article will help you get started.

What is Property Flipping?

Property flipping involves purchasing a property at below market value, renovating it, and then selling it for a higher price. It’s a straightforward concept, but successful flipping requires careful planning, market knowledge, and financial insight.

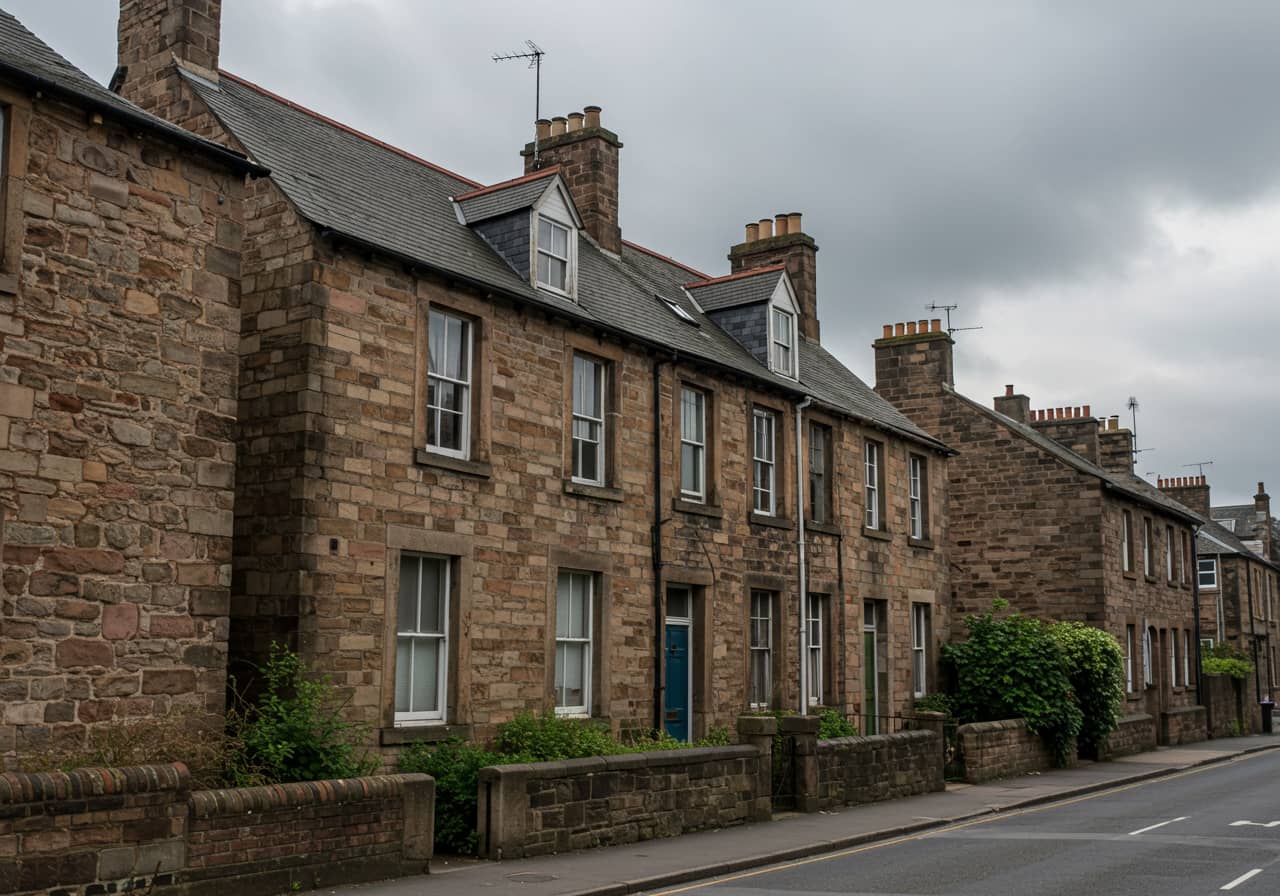

In Scotland, property flipping typically starts with finding properties that have the potential for value increases after renovations. These properties might be outdated, underpriced, or in need of cosmetic or structural repairs.

Flipping requires selecting the right property, budgeting for renovations, and understanding the local market. It’s not a simple task, but with careful planning and the right knowledge, it can be profitable.

Getting a solid understanding of the process is the first step to success in property flipping.

Is Property Flipping Right for You?

Property flipping can be profitable, but it requires the right approach, mindset, and willingness to take on some risk. Before diving in, it’s important to understand both the potential rewards and the challenges.

First, property flipping involves upfront costs, and there’s no guarantee you’ll make a profit. For example, if you purchase a property for £120,000 and spend £30,000 on renovations, you’ll need to sell it for at least £170,000 to make a profit.

However, if the market doesn’t support that price or unexpected repairs arise, you could face a loss. In some cases, costs can easily exceed initial estimates—minor repairs might turn into major structural issues that increase your costs by £10,000 or more.

First, you need to be comfortable taking on risk. Property flipping involves upfront costs, and there’s no guarantee of making a profit. If the property doesn’t sell for the expected price, or the renovation costs are higher than anticipated, you could end up losing money.

Second, patience and organisation are key. Property flipping isn’t just about doing quick fixes; it requires careful planning, budgeting, and managing the renovation process. You’ll also need to deal with various professionals, such as contractors, estate agents, and solicitors, which requires good coordination.

Property Flipping Process in Scotland

Property Flipping Process in Scotland

FInding The Property

The first step in property flipping is sourcing the right property. In Scotland, you can find deals through auctions, estate agents, or direct seller approaches. Look for properties that are priced below market value and have potential for improvement.

Consider location, condition, and the type of property you’re interested in flipping. Urban areas like Glasgow and Edinburgh often have more opportunities, but smaller towns like Falkirk and Linlithgow can offer hidden gems.

Financing the flip

And of course, you should secure your money first. You can’t flip a property if you haven’t figured out how to pay for it. Many people use traditional mortgages, but bridging loans or investor funding can help if you need quicker cash.

It’s important to make sure your financing covers the purchase price and the renovation costs, plus any unexpected expenses.

Renovating the property

Now comes the real work—renovating the property. This is where you make your money, but you have to be strategic.

Focus on upgrades that will bring the most value, like a modern kitchen, refreshed bathrooms, or improving the exterior for better curb appeal. Avoid going overboard with major structural changes unless absolutely necessary.

Stick to cosmetic changes that will give you the highest return on investment. Stay within your budget and keep a close eye on your timeline to make sure the renovation doesn’t eat into your profits.

legal and regulatory consideration

When flipping properties in Scotland, understanding the legal side of things is just as important as finding the right property and doing the renovations. The property market in Scotland has its own set of rules and regulations.

The missive process

In Scotland, when you buy a property, you enter into what’s known as “missives” with the seller. This is a legally binding process that starts when you agree on a price and ends when the transaction is completed.

It’s important to know that once the missives are concluded, you are committed to buying the property, unlike in other parts of the UK where contracts can be cancelled. Be sure to consult with a solicitor to manage the missives correctly and avoid any potential complications.

Title Deeds and Surveys

Before you purchase a property, ensure you get a proper survey. This will help you identify any hidden issues that could cost you later, like structural damage or hidden damp.

In Scotland, properties are sold with a Title Deed, which provides a detailed history of ownership and any legal issues tied to the property. Always review this thoroughly, especially if the property has any legal restrictions or potential disputes.

Planning Permission

If you’re making major structural changes to a property, like adding extensions or changing the layout, you’ll need to apply for planning permission.

This is a crucial part of the process, and failing to get the proper permissions can lead to fines or even forced removal of the work you’ve done. Even if you’re only planning cosmetic changes, check with your local council to make sure everything’s in order before you start.

VAT and Stamp Duty

In Scotland, the equivalent of stamp duty is called the Land and Buildings Transaction Tax (LBTT). If you’re buying a property over £145,000, you’ll need to pay LBTT, which is calculated based on the property’s purchase price. You’ll also want to be aware of VAT (Value Added Tax) if you’re renovating, especially on certain materials or services.

Hiring Professionals

When dealing with legal matters, don’t hesitate to hire professionals such as solicitors, surveyors, and planning consultants. Their expertise will ensure that you’re not missing anything important and that your property flip is legally sound. A good solicitor will also help you handle the paperwork and the missives process

Final Considerations Before Flipping Your First Property

Before jumping into your first property flip, there are a few things you need to get straight. It’s not just about finding a property and doing some quick renovations—there’s a lot to consider.

Taking these considerations seriously will make your property flip much more manageable. Stay realistic with your expectations and plan ahead. If you’ve got a solid plan and keep an eye on your finances, you’ll be better prepared to succeed.

If you’re serious about flipping properties in Glasgow, Falkirk, Linlithgow, or Edinburgh, Stewart Thomson Property offers coaching and referral programs to help you avoid costly mistakes and maximise returns.